Facts About Hiring Accountants Revealed

Table of ContentsSome Known Details About Hiring Accountants An Unbiased View of Hiring Accountants3 Simple Techniques For Hiring AccountantsSome Known Factual Statements About Hiring Accountants The Greatest Guide To Hiring AccountantsHiring Accountants Things To Know Before You Get This

One more beneficial benefit of working with an accounting professional is the opportunity for face-to-face communications. Building a professional relationship with your accountant develops trust fund, integrity, and clear interaction. On the internet systems can't supply this individual link. Having the capability to rest down with your accounting professional, ask concerns, and get immediate feedback provides a degree of convenience and confidence.

While on-line systems may offer speed and simplicity, they do not have human communication and a personalized approach to tax filing. If you choose to use an online platform, consider using an accountant. They can provide you suggestions and techniques to navigate the platform. In general, there is comfort that comes with understanding your taxes are in the hands of an expert and it will be a financial investment that repays past the April due date.

You would certainly expect a book-keeping company to be biased on the inquiry of whether or not startups and various other companies ought to hire an accounting professional. However is getting an accounting professional always the appropriate step? Probably not. In this article, we take a fair take a look at the advantages and downsides of using an accounting professional to support your start-up business.

An Unbiased View of Hiring Accountants

The great news is that it's an accountant's task to understand this sort of thing. That's why employing specialist assistance can usually conserve your service cash instead of being a cost.

Good record-keeping is important and you ought to be doing this anyhow. Nonetheless, we have actually found that several of our customers have changed and improved their procedures based upon our comments. We've shown them a far better method of managing their year-end processes, and that sort of change will profit them for years to come, whether they keep functioning with us or not.

Indicators on Hiring Accountants You Should Know

That's understandable: simply make certain to maintain great records to make sure that it's very easy for you to function with an accountant when that time comes. You might currently utilize somebody with all the skills essential to do the book-keeping work in-house. If that individual is currently occupying an additional duty, it may be possible to obtain them to handle their regular jobs and accountancy tasks as component of their normal working week.

Using an internal click this site person also suggests you prevent needing to execute due diligence on working with an accountancy firm. Analyzing the appropriate costs, solutions, locations and credentials all take time. Remember, as well, that anyone can call themselves an accounting professional or tax consultant despite the fact that they could not be certified via ICAS/ACCA/ICAW (we have these certifications!).

If your corporate culture and values is constructed along these lines, you'll need to employ people qualified of handling your accounts. This features its expenses, especially if those people have a devoted accountancy-only function in your organisation. This approach does not exclude you from possible inspection and bookkeeping from the relevant tax authorities.

Hiring Accountants Fundamentals Explained

We believe that wise start-ups are best off functioning with an accounting professional as quickly as they can. As our list reveals, there are factors for and versus doing so.

Have you dug much deeper to believe about what your normal daily might look like as an accounting professional? We have actually put with each other a list of audit pros and disadvantages to help you figure out exactly how the career may fit with your personality, functioning style and life top priorities.

Still questioning "what is accounting?" review much more in our various other short article below (Hiring Accountants). There's a great deal to enjoy regarding a job in accountancy. Learn a lot more concerning a few of the benefits you can anticipate by pursuing this career. If you're studying accountancy, you're finding out well-defined sensible skills companies require for a certain set of functions.

Getting The Hiring Accountants To Work

Basically every organization requires an accountant or the services of an exterior audit company, and even the average individual has reasons to hire an accountant discover here from time to time. As long as organizations exist and individuals need aid with tax obligations, there will be a demand for accounting professionals.

That's not necessarily the case with audit work. While chances do naturally often tend to focus in large populace centers, there's still a need for accountancy experts somewhere else. From farmers to government organizations to software program advancement firms, relatively everyone can utilize accounting solutions. This gives accounting professionals a fair quantity of flexibility when it pertains to choosing where they intend to settle downespecially as they proceed to gain experience."Every kind of business requirements accountants, therefore you can locate your method to operating in any market or sort of business that you desire," says Nate Hansen, a certified public accountant and owner at SuperfastCPA.

If that lines up with your profession goals, it can be a major benefit of a bookkeeping occupation. Simply like any type of market, working in bookkeeping may have its drawbacks.

The Single Strategy To Use For Hiring Accountants

In this sense, accounting careers use some variety in the annual timetable. When you're accountable for a company's financial resources, there is bound to be some stress.

2 Rasmussen University's Audit Certificate, Audit Associate's level, and Accounting Bachelor's degree do not fulfill the educational demands for licensure as a Certified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) in any stateEDITOR'S KEEP IN MIND: This article was originally composed by Carrie Mesrobian and published in July this article 2014. It has considering that been updated to 2023.

The most significant inquiry people ask themselves when it concerns submitting their tax obligations is whether they ought to employ a person to do their taxes for them. Employing a tax obligation accountant is a terrific means to aid you and offers extra advantages that you might not know. Doing your own taxes can assist you conserve time, conserve cash, and learn more regarding just how to file your taxes, however it can also put you in some tight spots if you do not know how to do your taxes.

Edward Furlong Then & Now!

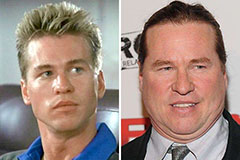

Edward Furlong Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Lucy Lawless Then & Now!

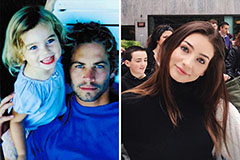

Lucy Lawless Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!